Financial Advice for Incorporated Professionals

Financial advice for incorporated professionals is often two-sided: advice for the practice and personal financial advice. A few things to keep in mind for professionals are:

- Professionals are typically in the highest income tax bracket, therefore incorporating their practice can help manage and defer taxes at a lower corporate tax rate.

- By incorporating professionals can have access to dividends from their corporation, shareholder loans, corporately held life insurance, and since money can be left inside a corporation this money can be used in years where there are life changes such as pregnancy, buying a home or retirement.

- Professionals should also ensure that they have access to health benefits.

- Debt for a professional is not unusual, given the costs of education and equipment, therefore, working with an advisor and accountant can help an incorporated professional find a way to balance their cash flow.

Why do you need Financial Advice?

- Worry less about money and gain control.

- Organize your finances.

- Prioritize your goals.

- Focus on the big picture.

- Save money to reach your goals.

For an incorporated professional, personal and practice finances are connected. Therefore both sides should be addressed: Personal and your Practice.

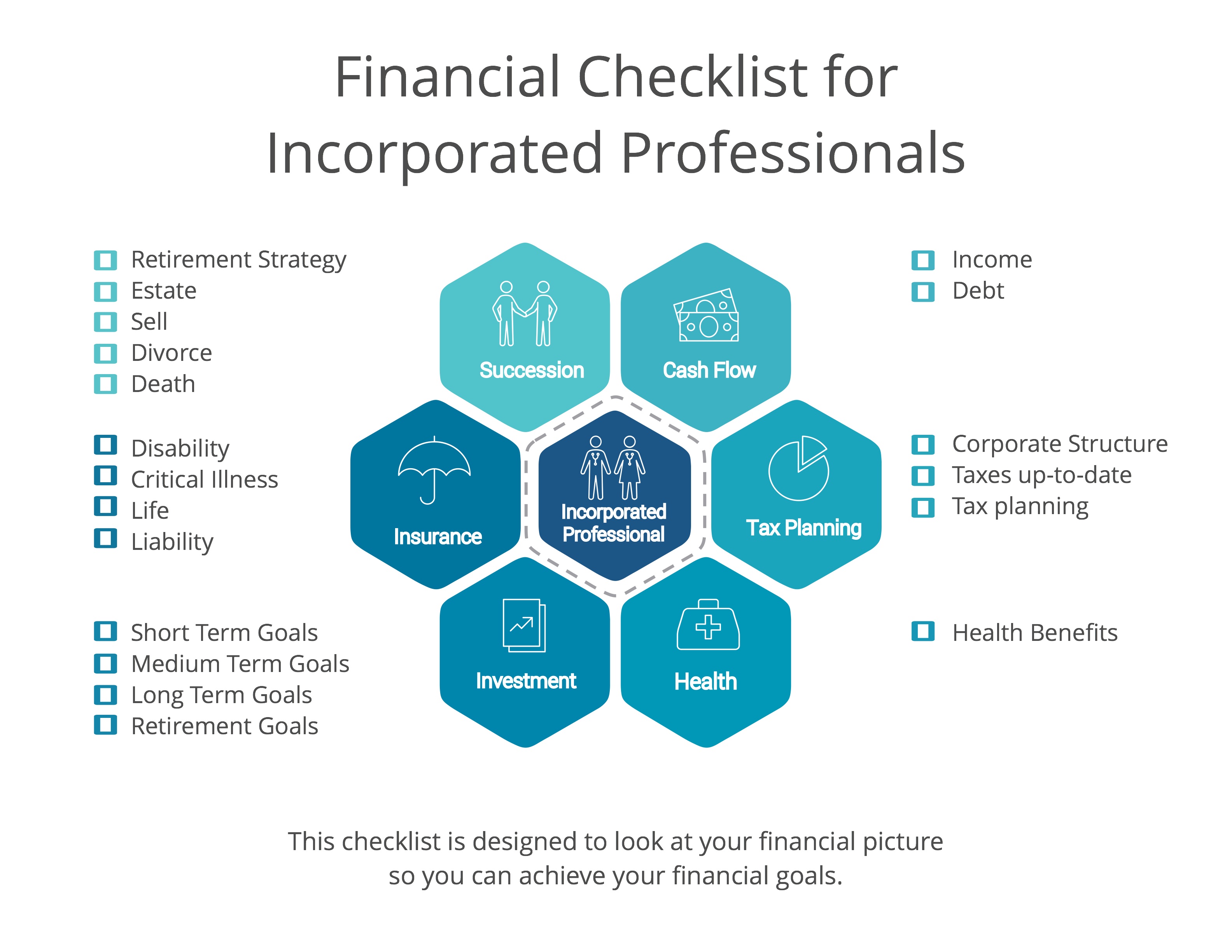

What does Financial Advice for an Incorporated Professional include?

There are two main aspects your practice’s financial plan should address: Growth and Preservation.

Growth:

- Cash Management – Managing Cash & Debt

- Tax Advice – Finding tax efficiencies

- Health Benefits

Preservation:

- Investment – either back into the business or outside of the business

- Insurance Planning/Risk Management

- Retirement Planning

What does Personal Financial Advice include?

There are two main aspects your financial plan should address: Accumulation and Protection.

Accumulation:

- Cash Management – Savings and Debt

- Tax Advice

- Investments

Protection:

- Insurance Planning

- Health Insurance

- Estate Planning

What’s the Financial Advice Process?

- Establish and define the financial advisor-client relationship.

- Gather information about current financial situation and goals including lifestyle goals.

- Analyze and evaluate current financial status.

- Develop and present strategies and solutions to achieve goals.

- Implement recommendations.

- Monitor and review recommendations. Adjust if necessary.

Next steps…

- Feel confident in knowing you have a plan to get to your goals.